Menu

The fast-growing global spirits company, Amber Beverage Group (ABG), has entered the bond market to fund its automated, high-bay warehouse development. ABG issued senior secured 4-year EUR 30 million bonds with investor demand exceeding EUR 45 million. Signet Bank (Latvia) acted as the arranger for the bond issue.

Amber Beverage Group is a rapidly growing global spirits company, whose products are found in millions of households and venues across the globe. The company has grown from its initial production business established in the Baltics to become a global player in the alcoholic beverages sector, employing over 2000 people. ABG’s core brands are Rooster Rojo® Tequila, KAH® Tequila, Moskovskaya® Vodka, The Irishman® Whiskey, Writers’ Tears® Whiskey, Riga Black Balsam®, Cross Keys Gin® and Cosmopolitan Diva®.

Jekaterina Stuģe, CEO of Amber Beverage Group, said: “Our entry into the bond market represents a significant step for Amber Beverage Group. We handle 1,400 own and third-party drinks products and our logistics and distribution operations worldwide are already impressive. As part of our policy of continuous improvement as we move towards attaining a position as a Top 10 spirits company worldwide, we want to further improve our efficiencies. We aim not only for smooth and cost-effective processes but systems that are contemporary, state-of-the-art, and sustainable. We continue to look at various M&A transactions and also at important development projects such as the advanced, automated warehouse project.

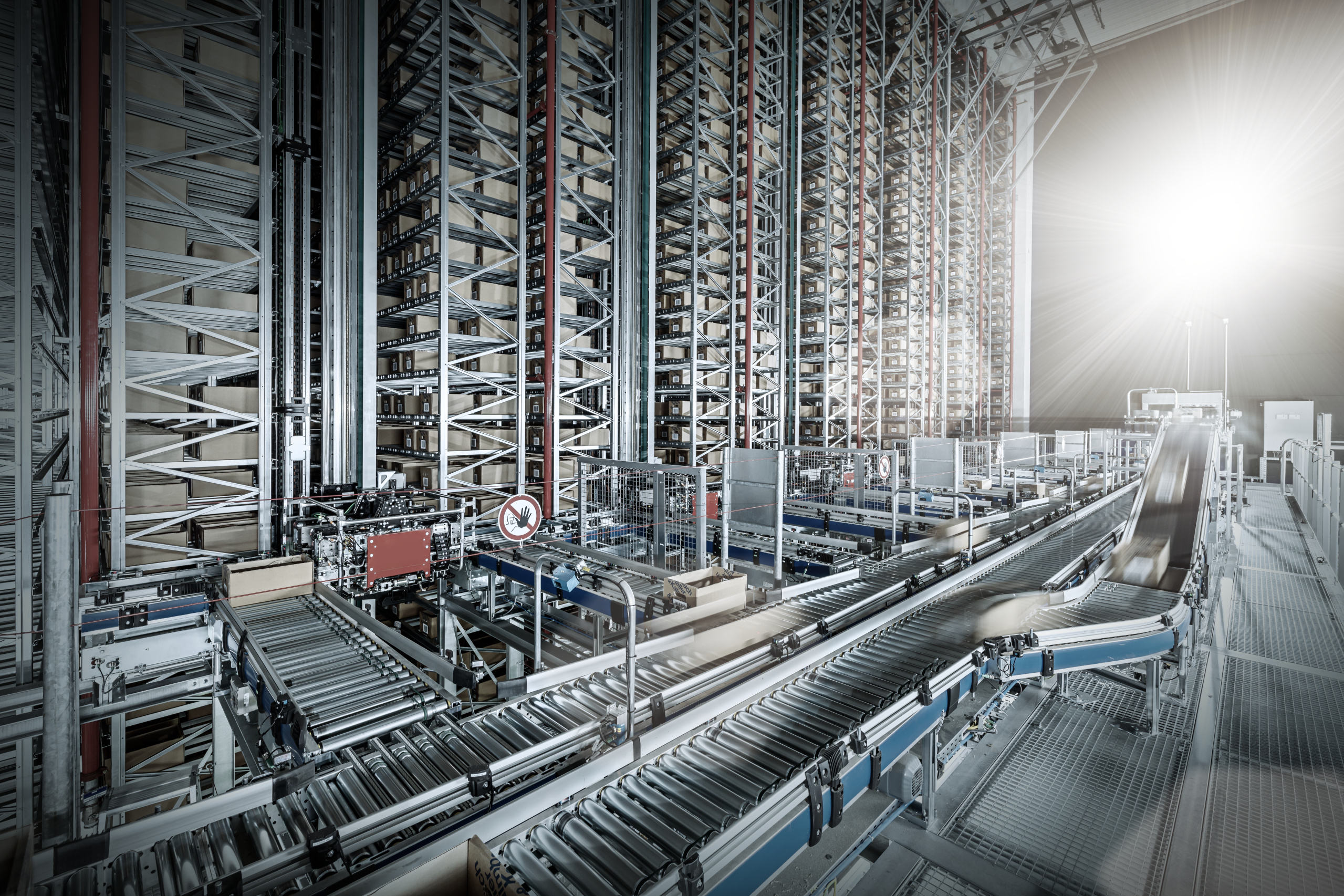

“The proceeds from the bond issue will be used to build a modern, 24,000 sq.m., fully automated logistics centre. It will be located in the Freeport of Riga, Latvia, the city from which the operational ABG head office team works. The new facility will increase warehouse capacity by around 30%, from 25,000 pallets to 35,000 pallets and improve the efficiency of the Group. It will incorporate the latest equipment, managed by a powerful warehouse management system. The warehouse technology will be supplied by Jungheinrich at a cost of EUR 15 million.”

Roberts Idelsons, CEO of Signet Bank, said: “We are delighted to introduce such a fast-growing company to the Baltic capital markets. The Amber Beverage Group bond issue saw an exceptionally high level of demand from both private and institutional investors from all three Baltic countries, with total demand exceeding EUR 45 million and more than 100 investors participating in the offering. This demonstrates the huge potential of the Baltic capital market for companies of various sizes and industries to raise financing for their development plans. Amber Beverage Group, with its strong position in the industry and ambitious expansion plans, sets an example for other ambitious Baltic companies of how capital markets serve as a stepping stone to achieve long-term goals and real alternative for bank lending. We congratulate Amber Beverage Group on its successful placement and look forward to active trading after the planned bond listing on the Frankfurt Stock Exchange Open Market and the Nasdaq Riga Regulated Market.”

According to preliminary financials for the year 2022, Amber Beverage Group achieved sales of EUR 365.8 million and an EBITDA of EUR 42.3 million in 2022. The Group produces, bottles, markets, distributes, exports, and retails a comprehensive range of beverages spanning everything from premium vodka and sparkling wines to speciality Mexican tequilas and Irish Whiskey. Amber Beverage Group operates in 16 countries including Austria, Australia, the Baltic States, Germany, Ireland, Mexico, and the United Kingdom.